Navigating the insurance claims process might seem daunting, but it doesn’t have to be. In this guide, we’ll walk you through the essential steps: filing a claim, documenting the damage, contacting your insurer, and finally, receiving your settlement. By the end, you’ll be equipped with the knowledge to manage your claims efficiently.

Key Takeaways

- Understanding the types of claims relevant to martial arts studios, such as injuries and property damage, is essential for mastering the insurance claims process.

- Thorough documentation and prompt communication with your insurer are crucial for ensuring a swift and successful claims process.

- Regularly reviewing your insurance policy and implementing preventive measures can reduce the likelihood of future claims and enhance operational safety.

Understanding Insurance Claims

An insurance claim is a formal request made by a policyholder to an insurance company for compensation or coverage for a covered loss. Insurance offers financial protection for martial arts studios and demonstrates a commitment to the safety and well-being of students, instructors, and visitors. This commitment helps build trust and credibility within the community.

Martial arts studio insurance provides comprehensive protection against various liabilities that can arise, such as injuries, property damage, and business interruptions. Liability insurance, in particular, safeguards school owners against claims and lawsuits related to physical injuries. It also covers medical costs and potential business income losses, allowing your operations to continue smoothly despite adversity.

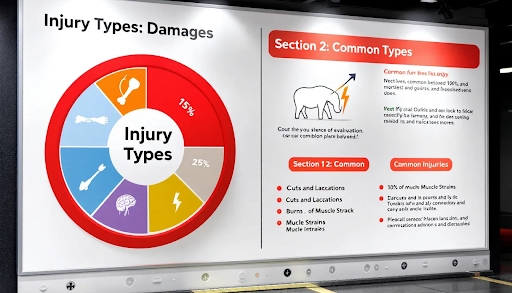

Common types of claims in martial arts studios include injuries sustained during training, property damage to the studio or equipment, and liability issues arising from accidents on the premises. Knowing these types of claims and how to manage them is the first step in mastering the insurance claims process.

Initial Steps to File a Claim

Immediately after experiencing a loss, the first priority is to ensure everyone’s safety and minimize further flood damage. For example, if there’s a flood or fire in your studio, evacuate the premises and call emergency services if needed. After addressing immediate dangers, follow the correct steps for filing a claim to start the recovery process.

Filing a claim involves several stages that need to be navigated carefully. Claims professionals can provide valuable support by guiding you through the recovery process and helping sustain your business operations during this challenging time. They offer expertise and insights that can make a significant difference in the speed and success of your claim.

Workers’ compensation insurance protects martial arts studios from financial liabilities related to injuries, covering necessary expenses and loss of wages. This coverage can also significantly reduce the risk of lawsuits resulting from workplace injuries, further safeguarding your business.

Connecting with Your Insurer

Promptly contacting your insurance provider after an incident is critical in the claims process. Timely communication ensures that the claims process is initiated without delay and that all necessary steps are followed. When you contact your insurer, provide a detailed list of damaged items, along with supporting photos and videos.

Providing witness information or contact details of other parties involved can assist the insurance adjuster during the investigation. Claims adjusters gather police reports, witness statements, and photographs to substantiate the claims they are investigating. A comprehensive collection of evidence is crucial for accurately assessing the situation and determining the insurance company’s liability.

Witness statements play a crucial role in validating claims and providing insights into the circumstances surrounding the incident. If issues arise with your claim, escalating the matter to higher-ups within the insurance company can increase your chances of resolution. Maintaining clear communication with your insurer throughout the claims process is essential.

Documentation and Proofs Required

Thorough documentation is vital for a successful insurance claim. This includes photos and incident reports that capture the extent of the damage and the circumstances surrounding the incident. Documentation should also include proof of purchase, receipts, police reports, owner’s manuals, and warranties relevant to the items involved in the claim.

Photographs and videos of damaged or destroyed items are crucial in supporting an insurance claim. These visual proofs help the insurance adjuster understand the severity of the damage and the necessary repairs. Keeping detailed notes about the damage and the circumstances will aid in the claims process.

Maintaining a written record of all communications with your insurer helps track the progress of your claim. Organized documentation and communication records can greatly enhance the efficiency and effectiveness of navigating the insurance claims process.

The Investigation Process

The insurance adjuster plays a pivotal role in the investigation process. They determine the loss amount and identify liable parties during the claim investigation. They evaluate the damage and ensure that the payout is justified according to the terms of the insurance policy. Establishing liability is crucial, as it helps determine who is responsible for the damages and how the payout will be structured.

After completing the investigation, the insurance adjuster reviews policy details and coverage to finalize the claim process. This review ensures the claim is resolved according to the insurance policy, providing clarity and resolution for both parties.

Reviewing Your Insurance Policy

Knowing the specific coverage details in your insurance policy can streamline the claims process. Exclusions in a policy specify situations or conditions that are not covered, which is crucial for understanding the extent of your coverage. Conditions in an insurance policy define the obligations you must fulfill, failing which your claim may be denied.

The Declaration Page outlines key information like the insured parties, coverage limits, and the duration of the policy. Endorsements and riders are modifications to the original policy that can change coverage terms; it’s important to review these changes regularly. Reading the policy in detail can prevent misunderstandings and disputes with the insurance company when filing a claim.

Knowing your insurance policy ensures it meets your specific needs and clarifies the responsibilities of both you and the insurer in case of a loss. Such a proactive approach can significantly reduce stress and confusion during the claims process.

Damage Evaluation and Repairs

The damage evaluation process starts with a thorough inspection, often using modern tools like drones and 3D imaging for accurate assessments. Technological advancements, including artificial intelligence, are streamlining the damage evaluation process and enhancing decision-making accuracy. Insurance adjusters may hire appraisers, engineers, or contractors for assessments.

Post-evaluation, the adjuster offers a list of preferred vendors for repairs. While hiring these preferred vendors is not mandatory, they are often recommended for their reliability and expertise. This ensures repairs are conducted efficiently and to a high standard.

It’s important for martial arts studio owners to be actively involved in the damage evaluation and repair process. Active involvement helps ensure all destroyed items are accounted for and repairs meet necessary standards, allowing the studio to recover and resume operations quickly, even if it means replacing worn mats.

Settlement and Payment

Filing a claim promptly can prevent delays in receiving compensation for your losses. The initial payment you receive is often an advance, not the final amount owed for the claim. Insurers may issue multiple checks for different aspects of the claim, such as structural damage and personal belongings.

In cases where a mortgage is involved, the claims payment check may require both the insured and lender’s endorsement. Additional living expenses (ALE) payments are typically made directly to the policyholder and cover costs incurred due to displacement. To obtain the full replacement cost for damaged items, policyholders usually need to purchase replacements and provide receipts.

If dissatisfied with your claim’s outcome, inform your insurance agent and escalate to their claims department if necessary. Prepare documentation and a written explanation to support your dissatisfaction with the settlement offered. You might consider hiring an independent arbitrator to determine if the settlement you received is fair.

Troubleshooting Common Issues

Responding promptly to requests from your insurer, even if they seem unreasonable, can help maintain a smoother claims process. Confirming any verbal agreements or promises made by your insurer in writing is crucial for creating a paper trail. This documentation can be invaluable if any disputes arise later in the claims process.

Damage evaluation challenges may include subjective interpretations and the need to guard against fraudulent claims. If you are unhappy with the outcome of your insurance claim, take steps to seek an adjustment. Knowing how to address common issues can help you navigate the claims process more effectively.

Preventive Measures for Future Claims

Detailed safety guidelines for both staff and students enhance overall safety and reduce injury risk. Safety protocols, instructor training, and documented safety procedures help martial arts studios prevent liability claims. Continuous professional development for instructors keeps them updated on the latest safety protocols.

Open communication among students encourages them to report any injuries or safety concerns without fear. First aid and CPR certifications for instructors are crucial for effectively handling injuries. Regular inspections of training spaces and equipment help identify hazards and prevent accidents.

A routine maintenance schedule for training equipment helps prevent accidents caused by wear and tear. A clean and organized training environment contributes to student safety and minimizes risks. These preventive measures can significantly reduce the likelihood of future claims and ensure a safe training environment by employing proper techniques.

Summary

Mastering the insurance claims process requires understanding the steps involved, from filing a claim to receiving a settlement. By providing thorough documentation, maintaining clear communication with your insurer, and understanding your insurance policy, you can navigate the process more effectively. Taking preventive measures can also reduce the likelihood of future claims.

In summary, being proactive and well-informed can make a significant difference in how smoothly and quickly you can recover from a loss. By following the guidelines outlined in this guide, martial arts studio owners can protect their business and ensure the well-being of their students and staff. Remember, preparation and knowledge are your best allies in the insurance claims process.

Frequently Asked Questions

Why is it important to file a claim promptly?

It is crucial to file a claim promptly to prevent delays in your compensation and to ensure all necessary procedures are correctly followed. Timeliness can significantly impact the outcome of your claim.

What documentation is needed to support an insurance claim?

To support an insurance claim, you will need crucial documentation such as photos, incident reports, proof of purchase, receipts, police reports, and any relevant warranties. Having these documents ready will strengthen your claim process.

How can I escalate an issue if I’m dissatisfied with my claim’s outcome?

To effectively escalate your issue, inform your insurance agent and move up to the claims department, while considering the use of an independent arbitrator to assess the fairness of your settlement. This structured approach can help ensure your concerns are addressed appropriately.

What preventive measures can help reduce the likelihood of future claims?

Implementing safety guidelines, maintaining protocols, and providing instructor training are essential preventive measures that can significantly reduce the likelihood of future claims. Regular inspections of training spaces and equipment further enhance safety and risk management.

How can I ensure clear communication with my insurer during the claims process?

To ensure clear communication with your insurer during the claims process, maintain a written record of all communications and confirm verbal agreements in writing. Providing detailed documentation will also support your claim effectively.